Texas House passes property tax relief bill that was passed by the Senate

House passes property tax relief bill passed by Senate

Thursday evening, the Texas House passed the property tax relief bill that was passed by the Senate Wednesday.

AUSTIN, Texas - Thursday evening, the Texas House passed the property tax relief bill that was passed by the Senate Wednesday.

Some House Democrats tried, and failed, to get some relief for renters too.

Just a few days after Texas’ big three announced a compromise to break their prolonged stalemate on property tax relief, the Texas Legislature took final steps late Thursday to send it off to the governor.

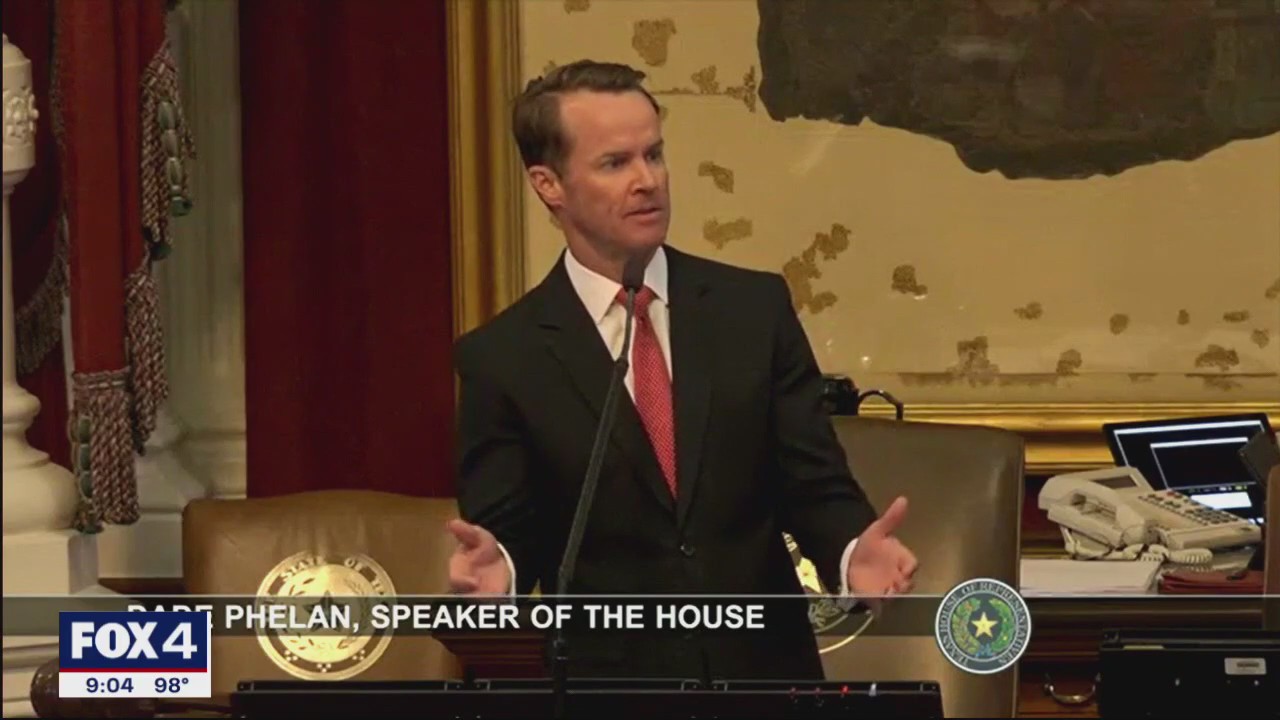

"Coming into this session, with a $34 billion surplus, we knew this would be the most contentious issue that we faced, was how to return these dollars to the taxpayers," Texas House Speaker Dade Phelan said.

The $18 billion plan calls for increasing the homestead exemption from $40,000 to $100,000, placing a cap on appraisal increases for commercial and non-homesteaded properties, and sends billions to school districts so they can cut property taxes.

Though the legislation package had overwhelming support, critics raised concerns Thursday.

"The rent is too damn high," State Rep. Gene Wu said.

One of the chief concerns is benefits to renters.

The plans’ architects have argued the benefits to property owners will be passed on to consumers, which some Democrats called bogus.

"Who out there watching this, who believes their landlord is going to give them a break instead of pocketing the money," Wu said. "They already raised rates once and they are going to do it again when they feel like it."

Critics also argued the plan missed an opportunity to help out schools.

Texas Tribune: $18B property tax cut deal, teacher pay

Karen Brooks Harper talks about the massive property tax cut deal that has passed through the Texas Legislature and what to expect for the third special session.

"We have lost an historic opportunity to do better by our kids, our teachers, and our schools," State Rep. Gina Hinojosa said.

But efforts by both Democrats, and even some Republicans, to tweak the plan were shot down.

"That was the deal that was struck and as time is of the essence to provide the tax relief to the great citizens of Texas, we need to stay by our deal," State Rep. Morgan Meyer said.

One of the measures passed is a constitutional amendment required to make the cuts.

Voters will have to sign off on that in November.