Texas homeowners must now verify homestead exemptions every 5 years — or risk losing it

TX homeowners must reverify homestead exemptions

If you get a letter from your appraisal district asking you to verify your homestead exemption, don't ignore it. Those who don't respond could end up losing their exemption and paying more in taxes. Here's what you need to do.

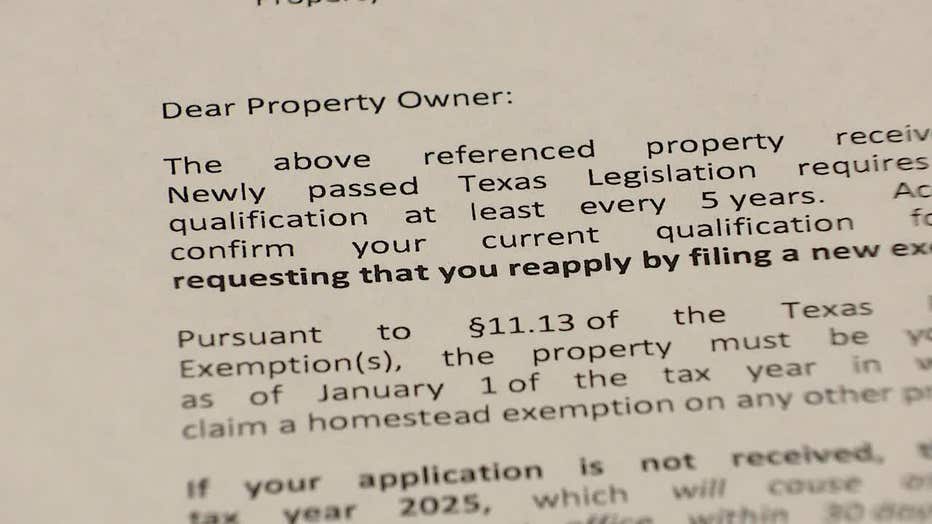

DALLAS - A state law that went into effect in 2023 requires every county appraisal district in Texas to verify your homestead exemption at least once every five years.

If you don't respond to the verification notice, you could lose your homestead tax exemption and pay more in taxes.

What is a homestead exemption?

Homeowners in Texas get a break with what's called the homestead exemption. It allows your taxes to be calculated at a rate lower than your appraised or market value.

Until recently, it was ‘set it and forget it’ for most.

However, state legislators passed a law in 2023 that requires the appraisal district in Texas counties to determine if you are still eligible for that exemption at least once every five years.

Featured

Texas voters overwhelmingly approve measure to increase homestead tax exemption

Texas voters overwhelmingly okayed Proposition 4 in the November election, meaning homeowners will get the biggest property tax rebate in state history.

Why you should care:

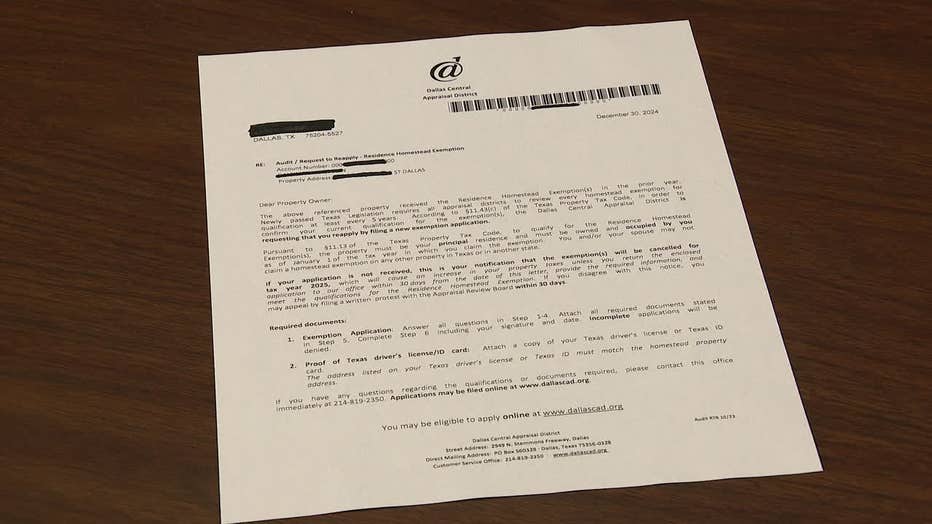

"We're going to send out a reapply letter the last week of December asking you to reapply within 30 days," said Shane Docherty, Dallas County’s chief appraiser. "If you don't, then we're going to remove it before we mail the notices on April 15 of that year."

If that happens, then you will be taxed at the full appraised or market value of your home, meaning you will pay more.

It’s what happened to homeowner Mike Bryson.

"This year, we got our tax bill, and we went from like a $6,000 or $7000 bill when we first moved in here to over $12,000. The first thing I looked on the statement, and the exemptions was blank," he recalled. "Trying to do some research. It disappeared somehow. And the county said, ‘You have to reapply. Of course, you have to pay the bill as is. And then it could take three to four months to get approved for your homestead exemption.’"

Texas: The Issue Is - Property Tax Fight (Part 2)

The Texas Trio discuss the political back and forth between Governor Greg Abbott and Lieutenant Governor Dan Patrick on the best way to lower property taxes.

How to check the status of your homestead exemption

What you can do:

Homeowners can check on the status of their homestead exemption by going to their county’s appraisal district website.

For a list of all county appraisal district websites, visit https://comptroller.texas.gov/taxes/property-tax/county-directory/.

A quick property search should reveal which exemptions are valid.

I lost my homestead exemption. Now what?

Docherty and Dallas County Deputy Chief Appraiser Cheryl Jordan explained the process of getting that exemption back once it's dropped.

"It's a two-page document. It's not that difficult to complete," she said. "It's some boxes to check. You sign your name and put some information down. You can probably have it done in about five minutes."

You must verify that it's your primary residence, and the address on your state-issued driver’s license or ID must match the physical address of your property.

Like the Dallas Central Appraisal District, all county appraisal districts should have the information up on their websites.

"If you have paid your taxes, and we don't have a homestead, and you file a homestead in a subsequent month, and we process it, we will notify the tax office," Docherty said. "We do that once a month every month, and then they will send you out a refund."

Bottom Line:

Don’t ignore any kind of mail you get from the appraisal district. Read it carefully.

And if you think you already have a homestead exemption, follow their instructions or give them a call. You can save yourself from having your taxes calculated at a higher rate.

The Source: The information in this story comes from interviews with chief and deputy appraisers at the Dallas County Central Appraisal District and North Texas homeowner Mike Bryson, plus information on the Texas Comptroller's website.